Can we predict any financial crisis? Can we take a look at the stocks at any moment and say whether the market is moving towards another booom. Everybody wants to have such an analysis in their bag.

This will not only help an organization avoid market losses but use that information to their advantage

A financial crisis is preceded by a financial bubble, where speculation reaches its maximum. In other words the stocks become highly correlated. So it does not matter where you are investing. Every stock would have a positive return

1) Multiple Correlation Coefficient

This is the basis of my analysis. On a particular exchange, If i observe the correlation statistics of all stocks and can prove that the correlation is converging then we can raise the flag. However with hundreds of stocks it is difficult to analyse the correlation matrix. So we have to come up with a singular number. So i used the Multiple Correlation Coefficient. You can reach more about it at http://en.wikipedia.org/wiki/Multiple_correlation

Let us assume that we have 100 stock prices. We can make the first stock price as the dependent variable and the rest of the 99 stocks as the independent.

We then calculate the correlation matrix for the 99 stocks which gives as the below matrix R

We then calculate the matrix C which is the correlation between the dependent stock and each of the 99 independent stocks

The Multiple Correlation Coefficient is now simply

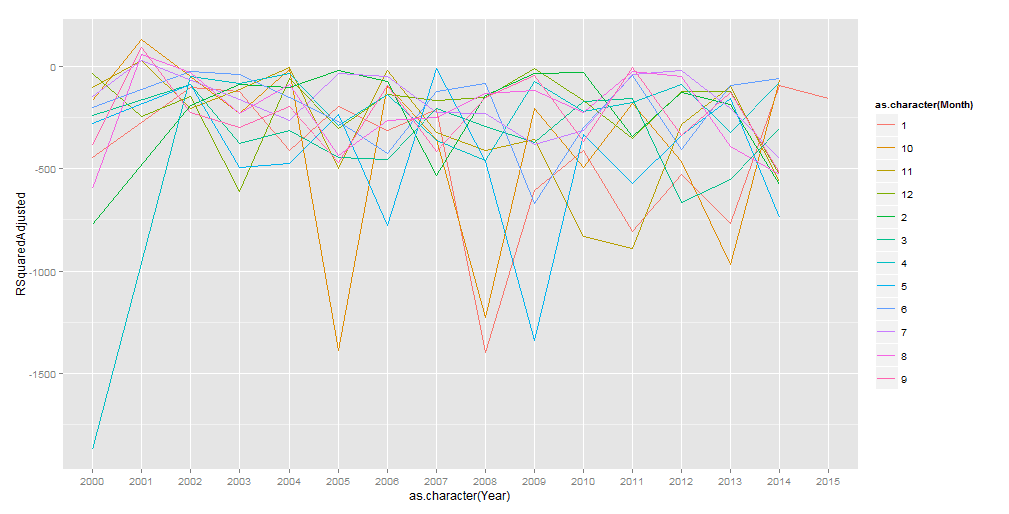

I took BSE(Bombay Stock Exchange) as my initial sample space. I have two graphs

The values plotted are for the Adjusted Correlation Coefficient from 2000 to 2010

The values plotted are for the Adjusted Correlation Coefficient from 2000 to 2014

However, the above method can be assumed to be brute force. We would like to intelligibly select the independent variables. I plan to use PCA and Cholesky for further analysis and compare the data

2) Principal Component Analysis

3) Cholesky Transformation

This will not only help an organization avoid market losses but use that information to their advantage

A financial crisis is preceded by a financial bubble, where speculation reaches its maximum. In other words the stocks become highly correlated. So it does not matter where you are investing. Every stock would have a positive return

1) Multiple Correlation Coefficient

This is the basis of my analysis. On a particular exchange, If i observe the correlation statistics of all stocks and can prove that the correlation is converging then we can raise the flag. However with hundreds of stocks it is difficult to analyse the correlation matrix. So we have to come up with a singular number. So i used the Multiple Correlation Coefficient. You can reach more about it at http://en.wikipedia.org/wiki/Multiple_correlation

Let us assume that we have 100 stock prices. We can make the first stock price as the dependent variable and the rest of the 99 stocks as the independent.

We then calculate the correlation matrix for the 99 stocks which gives as the below matrix R

We then calculate the matrix C which is the correlation between the dependent stock and each of the 99 independent stocks

The Multiple Correlation Coefficient is now simply

I took BSE(Bombay Stock Exchange) as my initial sample space. I have two graphs

The values plotted are for the Adjusted Correlation Coefficient from 2000 to 2010

The values plotted are for the Adjusted Correlation Coefficient from 2000 to 2014

However, the above method can be assumed to be brute force. We would like to intelligibly select the independent variables. I plan to use PCA and Cholesky for further analysis and compare the data

2) Principal Component Analysis

3) Cholesky Transformation

No comments:

Post a Comment