Twiddle Algorithm is the simplest of "intelligent" brute force algorithms that are out there. I have written a simple code to demonstrate how the algorithm works and as a sample data set, I have taken financial stock data for the past 5 years

# Implementation of a simple Twiddle Algorithm with Simple stock data

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

%matplotlib inline

# Let us get the stock prices of around 5 companies which we thing might have some relation to each other

# TATA STEEL

# ONGC

# DLF

# SBI

# MMTC

import pandas as pd

TATA=pd.read_csv('http://real-chart.finance.yahoo.com/table.csv?s=TATASTEEL.NS&d=11&e=26&f=2016&g=d&a=8&b=17&c=2011&ignore=.csv')

ONGC=pd.read_csv('http://real-chart.finance.yahoo.com/table.csv?s=ONGC.NS&d=11&e=26&f=2016&g=d&a=8&b=17&c=2011&ignore=.csv')

DLF=pd.read_csv('http://real-chart.finance.yahoo.com/table.csv?s=DLF.NS&d=11&e=26&f=2016&g=d&a=8&b=17&c=2011&ignore=.csv')

SBI=pd.read_csv('http://real-chart.finance.yahoo.com/table.csv?s=SBIN.NS&d=11&e=26&f=2016&g=d&a=8&b=17&c=2011&ignore=.csv')

MMTC=pd.read_csv('http://real-chart.finance.yahoo.com/table.csv?s=MMTC.NS&d=11&e=26&f=2016&g=d&a=8&b=17&c=2011&ignore=.csv')

# Prepare the data frame

data=pd.DataFrame(data={'tata':TATA['Close'],'ongc':ONGC['Close'],'dlf':DLF['Close'],'sbi':SBI['Close'],'mmtc':MMTC['Close']})

# Convert the data to returns

data=data.apply(lambda x : x/x.shift(1) -1,axis=0)

data=data[1:len(data)]

code. We will now be implementing two functions

1) errorFunction

This will return the sum of squared errorsa

2) twiddle

This is the actual implementation of the twiddle algorithm

# We will now be implementing the Twiddle algorithm

import numpy as np

def errorFunction(data,vectorArray):

squares=(np.dot(data[['dlf','mmtc','ongc','sbi']],np.array(vectorArray).T) - data['tata'] ) ** 2

return np.sum(squares)

def twiddle(data,weights,dweights,weightPosDelta,weightNegDelta,debug=False):

counter=0

weightHistory=pd.DataFrame(columns=('dlf','mmtc','ongc','sbi'))

for i in range(len(weights)):

bestError=errorFunction(data,weights)

while(1):

counter=counter+1

weightHistory.loc[counter]=weights

weights[i]=weights[i] + dweights[i]

error=errorFunction(data,weights)

if(abs(error - bestError) < 0.0001):

break

if(error < bestError):

bestError=error

dweights[i]=dweights[i]*(1+weightPosDelta)

else:

weights[i]=weights[i] - (2 * dweights[i])

error=errorFunction(data,weights)

if(error > bestError):

weights[i]=weights[i] + dweights[i]

dweights[i]=dweights[i] * (1-weightNegDelta)

else:

bestError=error

if(debug):

print("The weights are {} and the error is {} ".format(weights,error))

# We will plot the individual weights

plt.figure(figsize=(20,10))

plt.plot(weightHistory['dlf'],color='b',label='DLF')

plt.plot(weightHistory['mmtc'],color='r',label='MMTC')

plt.plot(weightHistory['ongc'],color='y',label='ONGC')

plt.plot(weightHistory['sbi'],color='g',label='SBI')

plt.legend()

plt.ylabel('Weights of the explanatory variables')

plt.xlabel('Counter Index')

plt.title('Variation of weights')

plt.show()

# We will plot the final curve

plt.figure(figsize=(20,10))

plt.plot(data['tata'],color='b',label='Actual')

plt.plot(np.dot(data[['dlf','mmtc','ongc','sbi']],np.array(weights).T),color='r',label='Twiddle')

plt.legend()

plt.ylabel('Price TATA STEEL')

plt.xlabel('Date Index')

plt.title('Actual vs Predicted')

plt.show()

return(weights)

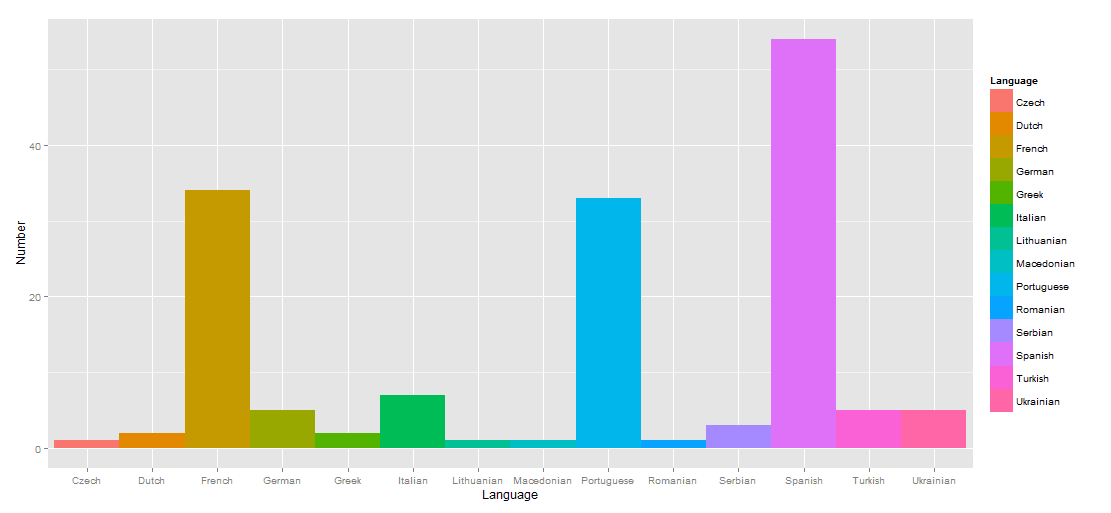

When we run the function, we will be getting the following output

1) Plot with the trend of how the individual weights evolve

2) Plot with the predicted(Twiddle) vs actual values

3) The final weights

dweights=[1,1,1,1]

twiddle_weights=twiddle(data,weights,dweights,0.1,0.1)

print(twiddle_weights)

We can see the way, the weights are recalculated. It is not a very robust algorithm, but it can be tweaked to your convenience

Play with it. A notebook is available in my github post

https://github.com/anantguptadbl/utilities/blob/master/Twiddle%20Algorithm.ipynb